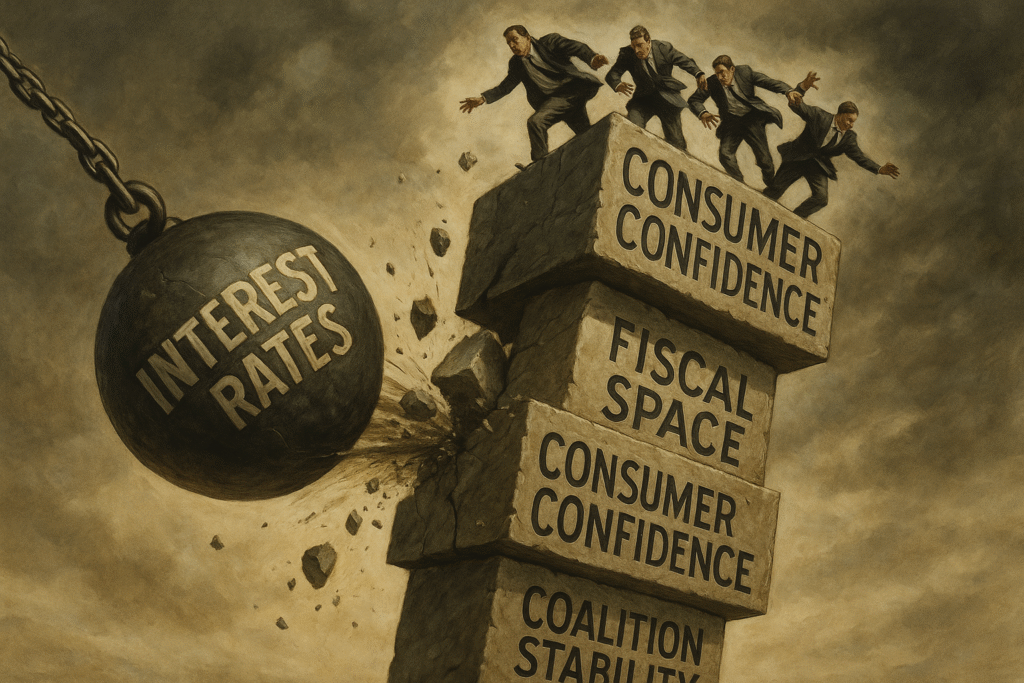

“When rates climb, governments fall. That’s not theory — that’s gravity.”

Abstract

The Law of Political Gravity argues that expensive capital converts economic stress into political collapse. In 2025, prime ministers in France, Japan, the Netherlands, Lithuania and Nepal resigned as high interest rates lifted debt service costs, squeezed households and eroded coalition stability. The causal chain is consistent: rates rise, fiscal space narrows, investment slows, consumer confidence falls, protests grow, parliaments fracture, and leaders become the release valve. Evidence spans soaring French servicing burdens, Japan’s imported inflation, Dutch mortgage pain, Lithuania’s renewed price anger and Nepal’s fragility. Capital cost, not ideology, has become the decisive variable in government survival.

In the past three months, prime ministers in France, Japan, the Netherlands, Lithuania, and Nepal have resigned. These are not fragile states on the periphery. They include some of the most developed economies in the world. Their leaders did not fall because of wars, coups, or scandals alone. They fell because economic pressure translated into political instability. The common denominator is the high interest rate regime that now defines the global economy.

When capital becomes expensive, the pressure begins quietly but builds relentlessly. High interest rates restrict fiscal space, increase debt servicing costs, and make the cost of living heavier for ordinary households. Businesses delay investment, governments struggle to cushion their populations, and every attempt to spend is met with the burden of higher borrowing costs. What begins as a financial constraint evolves into an economic squeeze felt across society.

France: Collapse Under Debt and Rates

France’s prime minister resigned after losing a confidence vote that centered on handling ballooning national debt and sharply higher interest payments. The government faces a record €3.35 trillion debt pile, with the debt-to-GDP ratio at 116%, and debt servicing costs now projected at €55 billion for 2025—one of the highest in the eurozone. Consumer confidence has simultaneously plunged, reflecting widespread anxiety about living costs and fiscal consolidation. French bond yields have risen abruptly following political turmoil, outpacing those of Spain, Portugal, and Greece, and investors are bracing for a possible downgrade to France’s sovereign credit rating.

Japan: Imported Inflation and Policy Paralysis

Japan’s prime minister, Shigeru Ishiba, resigned following a series of electoral losses driven by public anger over rising living costs, which are exacerbated by imported inflation from a weaker yen and higher global rates. Food prices have climbed 5% while wage growth has lagged, creating broad household distress. The political vacuum has prompted speculation the Bank of Japan will postpone further rate hikes, deepening uncertainty and exposing the vulnerability of leadership under conditions of expensive capital.

Netherlands: Mortgage and Coalition Meltdown

Dutch Prime Minister Dick Schoof stepped down after the collapse of a fractious coalition, with parties unable to respond decisively to mass concerns about housing, rising mortgage costs, economic security, and a negative public sentiment fed by expensive borrowing. The breakdown came as households struggled with higher living costs and major fiscal constraints, crippling the government’s ability to act and fracturing coalition unity.

Lithuania: Inflation Shock and Renewed Protest

Lithuania’s Prime Minister Gintautas Paluckas resigned less than a year into office after corruption allegations were inflamed by renewed inflation protests and persistent public dissatisfaction over economic management. The system had already been scarred by an earlier inflation shock; accelerating prices and fiscal restrictions amplified pressure on governance and coalition viability. The situation laid bare the limited tolerance for fragile leadership in tightening monetary environments.

Nepal: Corruption and Global Tightening

In Nepal, mass protests against corruption—intensified by government incapacity to buffer ordinary citizens from global economic tightening—forced Prime Minister KP Sharma Oli to resign after deadly unrest. While local triggers were political, the underlying inability to shield the population from the effects of rising rates and imported inflation compounded instability.

Political systems absorb this pressure the only way they can. Parliaments fracture, coalitions collapse, and leaders are cornered. Resignations become the release valve. This is not about left or right, conservative or progressive. It is about the limits of endurance under a high rate world. Cheap money once masked fragility. Expensive money exposes it in the open. Leaders who cannot provide relief or a convincing narrative of resilience are quickly replaced.

This is what I call the Law of Political Gravity. When capital tightens, governments fall. Interest rates are not just technical levers of monetary policy. They are the hidden weights pulling down leaders across the world. The cost of capital has become the decisive variable in political survival. In the new era of capital based economics, those who can master resilience, allocate capital strategically, and shield their societies from the tightening cycle will outlast those who cannot.