Maybe the game isn’t about winning in normal times. It’s about thriving when the world is burning.

Abstract

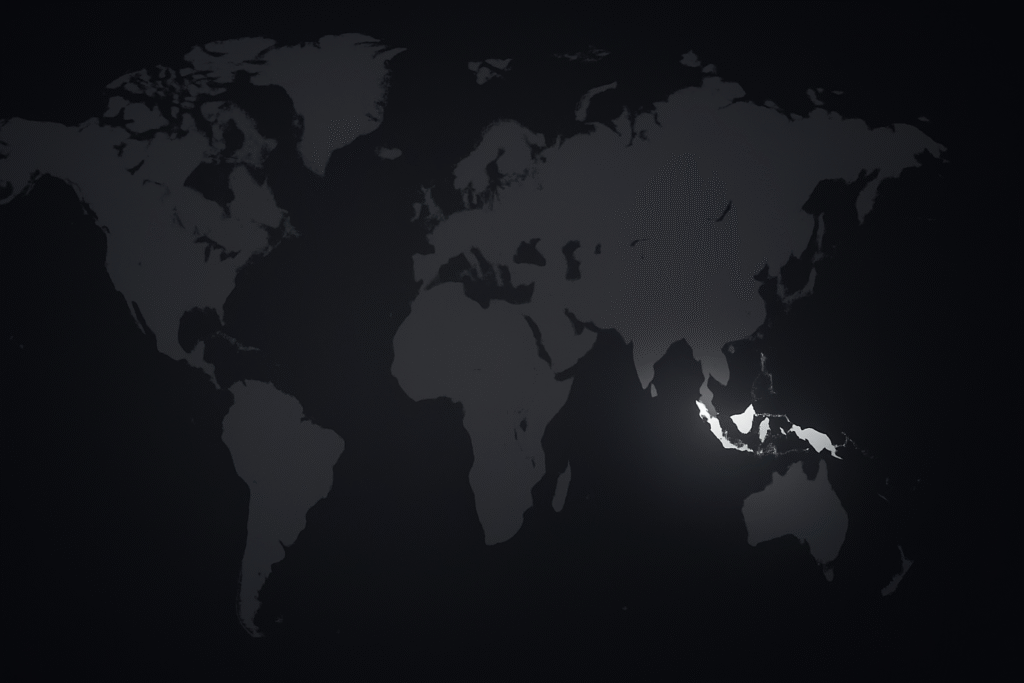

Black Swans—2008, COVID-19, Ukraine, AI—are not random shocks but power transfers. Nations that rise are those prepared to catch the shift. Indonesia must embed resilience into its architecture: control food and energy as power assets, treat capital as a wartime weapon through Danantara, and build a Crisis Arbitrage Playbook to buy when others sell. Focus over FOMO is key—prioritize food, energy, water, mobility, talent, not hype cycles. When the next Black Swan strikes, others will panic; Indonesia must deploy. And with the right narrative, we won’t just endure collapse—we’ll be seen as designed for it.

A Black Swan is not just any shock—it’s the kind of event no one sees coming until it’s already rewriting the rules. The 2008 financial collapse, COVID-19, the Russia-Ukraine war, even AI’s recent acceleration—none were expected in form, but all changed the global order. These aren’t just events; they are power transfer mechanisms. And the truth is, power doesn’t vanish—it moves. The only question is: are you positioned to catch it?

From Playing Defense to Engineering Resilience

For decades, Indonesia has played defense—reacting to volatility, not mastering it. But a new strategy is emerging. One that doesn’t try to predict the next crisis, but instead builds sovereign resilience into the architecture of the state. It begins by rethinking what truly matters when the global system buckles: control over food, energy, capital, and narrative. These are not buzzwords. These are survival assets in disguise. And if mobilized properly, they form a national advantage.

- Food and Energy Are Power Assets—Not Just Commodities

That’s why Indonesia must start where most macroeconomists end: real assets, not theoretical projections. Food and energy are not just commodities—they’re geopolitical weapons. In a world where supply chains collapse, who feeds and powers the region controls the game. That’s why we must treat rice, palm oil, fisheries, gas, and coal not as exports, but as leverage. We need sovereign control from port to plate, from well to wire. And we must embed this logic inside Danantara—not as a CSR side-show, but as a strategic capital mandate.

- Capital Is the Weapon—If You Know How to Use It

The second axis is capital itself. Budgets are rigid. But capital—if governed right—is a weapon. During a crisis, budgets freeze. But sovereign capital moves. That’s why Danantara must not act like a passive investment vehicle. It must evolve into a war room of capital orchestration. This means treating capital deployment like wartime triage: investing in what’s resilient, pulling out from what’s fragile, and redeploying instantly as new threats or opportunities emerge. It means abandoning the GDP optics game and focusing instead on resilient cashflow, strategic asset control, and long-term economic sovereignty.

- Watch the World. Wait. Then Strike.

Third, we must monitor the world for cracks—not with fear, but with intent. A Black Swan doesn’t destroy value. It reveals who was swimming naked and who kept reserves. In every crisis, assets fall to discounts. Companies, ports, farmland, entire supply chains go on sale. Indonesia must build a “Crisis Arbitrage Playbook,” backed by a sovereign liquidity buffer, so that when others are forced to sell, we become the buyer. Not just for gain, but for positioning. That is how nations build wealth during collapse—not after recovery.

Focus Over FOMO – Keep Well Positioned Untill The Black Swan Emerges

Resilience isn’t just about preparation. It’s about focus. Indonesia must not fall into the trap of chasing every global trend. In a noisy world—where FOMO drives policy—it takes discipline to stay still. While others bet on hype cycles—overfunded EV startups, burning AI valuations, flashy ESG tokens—we double down on fundamentals. We prioritize what survives any collapse: food, energy, water, mobility, and talent. That’s the real portfolio of the future. Not unicorns, but utilities.

And when the time comes—and it will come—the Black Swan will not announce itself. It will be sudden. Uncomfortable. Confusing. That is the moment of truth. Not for panic. But for deployment. At that precise moment, nations without strategy will freeze. Their capital will be trapped. Their leaders will hold emergency meetings. Meanwhile, Indonesia—if we prepare now—will already have the playbook ready: whom to call, what to buy, how to act. We become the lender, the feeder, the buyer, the port. We don’t just survive the storm—we profit from its disorder.

Perception Is Power: Win the Narrative, Win the Game

But perhaps the most underrated weapon in a Black Swan event is the narrative itself. In global chaos, perception becomes currency. If Indonesia is to rise, it must not only act—it must be seen as the nation that was prepared. That means owning the story: crafting a public doctrine of strategic capital, publishing a Sovereign Resilience Index, and showing the region that we didn’t just ride out the storm—we were designed for it. Narrative attracts talent. It moves capital. It builds reputation. And it can even shape foreign policy.

The Ultimate Question: Will We Be Shocked—or Ready?

In the end, the question is not whether the next Black Swan will come. It’s when—and who benefits. Indonesia does not need to know the form of the crisis. We only need to build our state architecture around volatility. Food and energy must be secured. Capital must be orchestrated like a war general, not a bureaucrat. Global cracks must be watched not with worry, but with readiness. And above all, we must tell the world: we are not afraid of collapse. We were made for this.