Abstract

Modern states run on a broken model: balance budgets, raise taxes, and plug deficits with debt—reactive tactics that extract wealth from both present and future generations without ever building a sustainable revenue engine. Debt mortgages tomorrow, while taxes suffocate today’s productivity, leaving governments as glorified distributors of money they don’t earn. The real problem isn’t deficits—it’s the absence of a sovereign cash machine. The solution is Statecraft Capitalism: transforming governments from passive spenders into capital architects who design national engines that generate recurring returns. This means sovereign capital platforms, GDP-yielding infrastructure, and assets in food, energy, and digital security that multiply value, not just subsidize. The challenge is no longer technical—it’s philosophical. Leaders must abandon survival economics and embrace capital sovereignty. The legacy of this decade must not be budgets balanced by taxes and IOUs, but sovereign capital systems that compound national wealth and safeguard dignity.

Fundamental Problem: No State Sustainable Revenue Model

For too long, governments have been trapped in an outdated economic doctrine.

They teach policymakers to think like accountants: balance budgets, absorb spending, raise taxes, and plug deficits with debt. But this model—crafted for post-war recovery, not 21st-century complexity—is now broken. It’s reactive, not strategic. It’s flow-based, not asset-based. And it’s fundamentally disconnected from how capital, markets, and real growth behave today. In this system, governments become glorified distributors of money they don’t even earn. They rely on taxpayers like a startup stuck on crowdfunding. Worse, when they run out of tax room, they borrow—creating debt obligations that they never designed a machine to repay. This isn’t economics. This is short-term survival dressed up as policy.

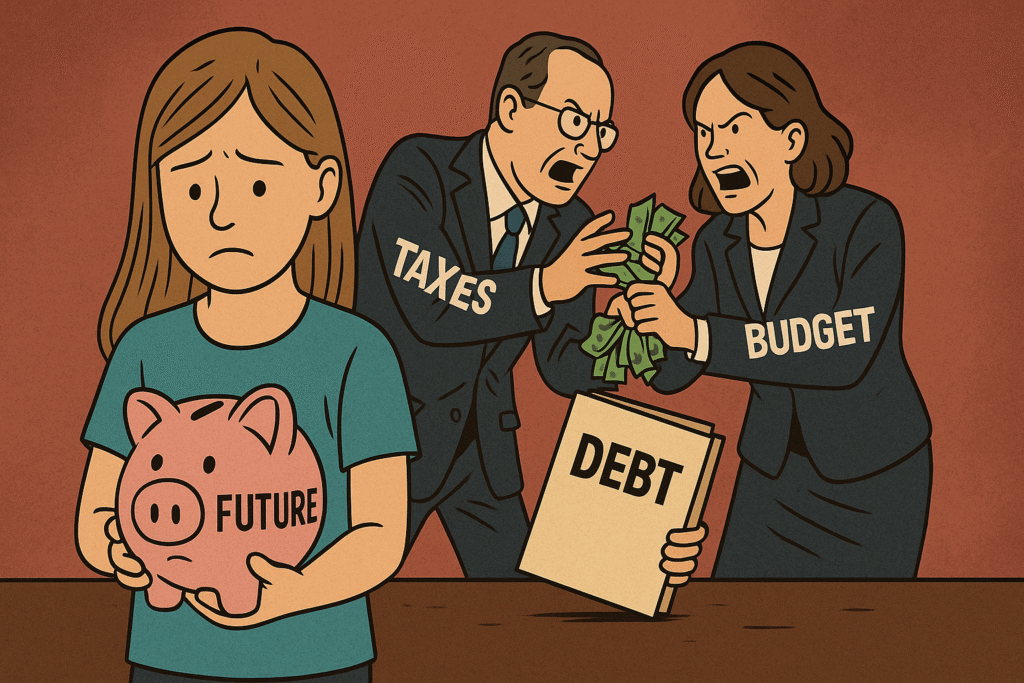

Debt and Taxes Mechanics on Wealth Elimination

Let’s think in simple logic: every time a government borrows, it is spending wealth that belongs to future generations. When a state runs a deficit and plugs it with debt, it’s not just borrowing—it’s time-traveling into the future and extracting the prosperity of grandchildren who haven’t even been born yet. They’re mortgaging tomorrow to survive today.

On the other hand, when taxes are raised to close the gap, the current generation pays the price through higher cost of living, reduced purchasing power, and diminished entrepreneurial spirit. The middle class becomes squeezed. The working class becomes angry. Businesses become cautious. Inflation rises—not just through monetary policy, but structurally through overburdened productive capacity. More taxes and more debt are not solutions.

They are symptoms of a system that refuses to generate its own income. In fact no serious enterprise in the world operates like this. Any CEO who constantly borrows to cover salaries without ever investing in productive capital would be fired. And yet this is exactly how modern states behave—year after year. The deeper issue isn’t the deficit. The deeper issue is this: they don’t have a cash machine.

The Solution: A Statecraft Capitalism

What the world needs is a migration to a new model—what we call Statecraft Capitalism. This is not capitalism in the conventional neoliberal sense. This is capital strategy at the sovereign level. The goal? To transform governments from passive budget managers into active capital architects. Instead of just spending, they must build national capital engines—strategic investments that earn recurring returns to finance public goods and long-term resilience.

Think sovereign capital platforms. Think infrastructure that yields GDP, not ribbon-cutting headlines. Think food, energy, and digital security backed by productive assets—not just subsidies. The game is not about how much the government spends, but how well it allocates. That’s how we move from fiscal dependency to capital sovereignty. It’s how nations survive in a post-debt, high-volatility world. It’s how we turn strategic economics into a real policy engine—not just academic theory.

This is already possible. The tools exist. The only thing missing is courage. Courage to rethink the role of the state. Courage to admit that the old playbook has failed. Courage to design a better one.

A Call

So this is a call—not just to economists, but to every leader who claims to care about the next generation:

- You cannot call yourself responsible while handing your children a debt burden you never solved.

- You cannot talk about legacy while running a state without a revenue engine.

- You cannot promise prosperity while relying on taxes and IOUs.

We don’t need another fiscal rescue. We need a philosophical one. The greatest gift leaders can leave is not a surplus budget—it’s a sovereign capital system that generates, compounds, and protects national dignity. The old model is dying. The question is whether we will replace it—or let it rot while pretending it still works.

Let this be the decade where nations evolve from budgeting to capital engineering. Let this be the turning point when we say:

“Enough debt. Enough tax. Let’s build the machine.”