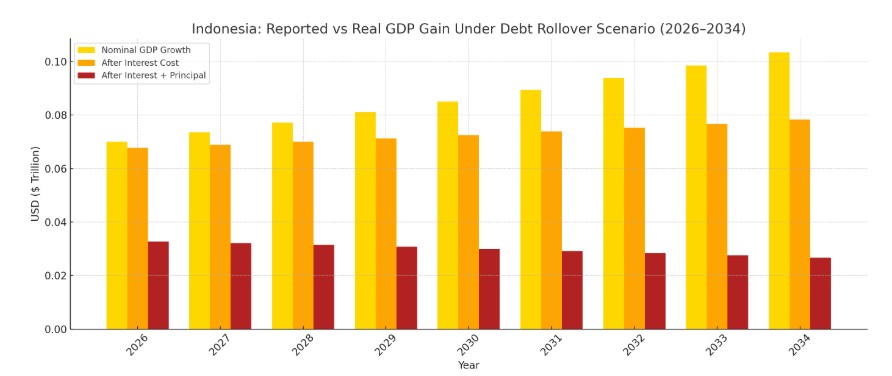

Indonesia may report 5% growth, but when you subtract interest and debt repayments, the real progress is a fraction of what it seems. This chart shows why we must shift from a debt-fueled to a capital-driven model.

For nearly two decades, Indonesia has hovered around 5% annual GDP growth — a number that policymakers, markets, and institutions have come to accept as “normal.” But behind this stability lies a dangerous imbalance: we’re financing growth using debt that costs more than the value it creates.

In 2025, bond yields are projected to hit 6.8%, while real GDP is expected to grow only 4.87%. That means every rupiah borrowed weakens — not strengthens — our economic base. What looks like development is, in fact, silent erosion.

The Hidden Cost of Rollover Economics

Indonesia’s current model relies on issuing bonds worth around 2.5% of GDP annually, with average yields between 6.5% to 7%. But these debts aren’t retired — they’re rolled over. As the government adds new obligations to pay off old ones, a compounding interest burden builds in the background.

From 2026 to 2034, Indonesia is projected to gain $771 billion in nominal GDP. But after paying $117 billion in interest and rolling over $386 billion in principal, the real value retained is just $268 billion. That’s an effective annual growth rate of only 1.97%, not the 5% headline we’re told.

By 2034, while the official story will celebrate a $105 billion GDP increase, the actual retained value after all financing costs is just $28 billion.

Serving Markets, Not the Nation

This isn’t just poor math — it’s a strategic failure.

A nation cannot thrive when its economy is designed to please credit rating agencies rather than its own people. We’ve been managing for “deficit ceilings” and “fiscal targets,” not for sovereign wealth creation.

Our ministries still operate under 20th-century fiscal logic: absorb the budget before year-end, hit disbursement KPIs, avoid audit issues. But where is the multiplier? Where is the return-on-capital logic?

We are stuck in spreadsheet economics, not sovereign strategy.

And this is the betrayal: economic thinking has drifted away from serving the nation’s long-term value, and into serving the bond market’s short-term comfort.

You Can’t Scale an Outdated Model

Let’s stop pretending that 5% GDP growth is a win when it’s powered by 6–7% bond yields. That’s not growth. That’s debt monetization with lipstick.

The system is not broken because of debt itself — but because of how that debt is used. We’re not investing. We’re plugging fiscal holes. We’re not compounding capital. We’re recycling obligations.

And worse, the people — not the government — carry the burden. You, me, and the generations after us will repay loans that never created real national value.

So, are we going to keep operating with this dusty playbook? Or do we start building a real capital strategy?

From Budget Manager to Capital Architect

Indonesia doesn’t need more fiscal compliance. It needs capital governance.

We must shift from deficit logic to investment logic, from budget absorption to capital allocation, from annual targets to compounding engines.

This is where Danantara must evolve. Not as a PR tool or ceremonial fund — but as Indonesia’s central capital allocator. A true strategic investor. A sovereign value creator.

Danantara must deploy capital with GDP-multiplier logic, not just profit motives. It must track payback periods, enforce capital discipline, and make every rupiah work harder than its cost. That’s what real capital stewardship looks like.

Capital Is No Longer Scarce — It’s Directionless

The world isn’t lacking money — it’s lacking alignment. There’s capital everywhere. What’s rare is the ability to strategically direct it.

Indonesia has abundant state-owned assets, pension funds, public land, and financial institutions. What it lacks is a coordinated doctrine — a strategy that ties it all together into a compounding national machine.

We must build that architecture now. And it begins by abandoning the illusion that debt-led growth can carry us further.

The Time Is Now

If we continue with the same debt logic, over three-quarters of our future GDP gains will be lost to interest and rollovers. We will celebrate numbers that don’t translate into national value. That is not just inefficient — it is unjust.

Dear President Prabowo,

Wes wayahe.

It’s time to stop managing the economy like a charity, a report, or a compliance unit.

It’s time to govern capital.

Let’s build a system that compounds wealth for the people — not obligations for the creditors.