Abstract

Danantara has been misjudged as a mere investment entity or a Temasek clone, with critics focusing narrowly on profitability, BUMN reform, or governance risks. In reality, its essence lies in sovereign capital allocation: the deliberate centralization of financial flows under President Prabowo as a tool of national power. Unlike Singapore’s stability-oriented Temasek, Danantara is designed as a power mechanism—consolidating resources, recycling capital for strategic interests, and creating a parallel economy independent of oligarchic and foreign dominance. Its secrecy before the election ensured swift execution free from elite resistance, positioning it as a geopolitical fortress rather than a financial fund. Efficiency and market metrics are secondary; the true measure is control over who gains access to capital and how it advances national projects. By reframing capital as an instrument of sovereignty, Danantara signals Indonesia’s shift from passive market participant to active architect of its economic destiny.

Introduction: The Wrong Conversation

Since its announcement, Danantara has faced widespread criticism. The mainstream narrative mistakenly revolves around:

- Whether it will improve BUMNs

- Profitability prospects

- Foreign investment attraction

- Potential misuse by political elites

Yet all these points miss the true essence. To begin this, let us propose an 8% GDP growth question: “Who controls capital allocation for Indonesia?.”

The Buffett Model, Elevated: Capital Allocation as Sovereign Control

Warren Buffett famously stated his job is identifying rational managers for efficient capital allocation. Imagine! controlling capital not just for one company but for an entire nation.

- Buffett chooses good companies.

- President Prabowo decides who even gets capital.

- This isn’t stock-picking — it’s sovereign-level capital control.

Comparing Danantara with Temasek is fundamentally FLAWED!. Singapore structured Temasek within an existing governance system, focusing on stability, modest returns, and sovereign security — recent returns of around 1.6% suggest profitability is secondary to protecting national interests (learning from Russia US$ 300 billion freezed assets). Indonesia’s Danantara, however, is intentionally designed to establish a new power-centric system, prioritizing direct control of capital flows and strategic national interest over conventional profitability metrics.

The Danantara Five Blind Spots Framework: Why Critics Misunderstand

Most analysts fail to grasp Danantara’s real objective because of five flawed perspectives:

1. The Capital Trap: Treating It as a Standard Investment

“Danantara is just an ineffective Temasek clone.”

Danantara’s main goal isn’t profitability — it’s centralized control of capital under President Prabowo.

2. The Institution Fallacy: Believing BUMNs Should be Privatized

“Danantara must be run by professionals, not politicians.”

Institutions don’t shape power; power shapes institutions. Danantara isn’t fixing BUMNs — it’s deciding who controls their financial streams.

3. Geopolitical Blindness: Ignoring Sovereignty and Independence

“Negative market reactions mean Danantara failed.”

Short-term market fluctuations are irrelevant. Global financial players prefer Indonesia dependent (Come on! are we blind on this?). Danantara ensures capital sovereignty, reducing foreign influence.

4. The Power Chessboard: Mistaking Economic Growth as the Main Goal

“Danantara must prioritize efficiency.”

Efficiency is secondary — control is primary. Previously fragmented among various factions, BUMN resources now flow exclusively through it, securing strategic alignment with national interests.

5. The Hidden System: A Self-Sustaining Power Mechanism

“Danantara faces governance challenges and long-term risks.”

It is deliberately designed as a sustainable system to maintain direct control over power access and key decision-makers:

- Resource Centralization: Consolidates fragmented capital under unified state control.

- State-Driven Capital Recycling: Directs investments according to national strategic interests rather than private gains.

- Parallel Economy Creation: Forms an alternative financial structure independent of traditional oligarchic elites.

- Regulatory Capture & Financial Leverage: Gains direct influence over financial institutions, infrastructure, and foreign investments.

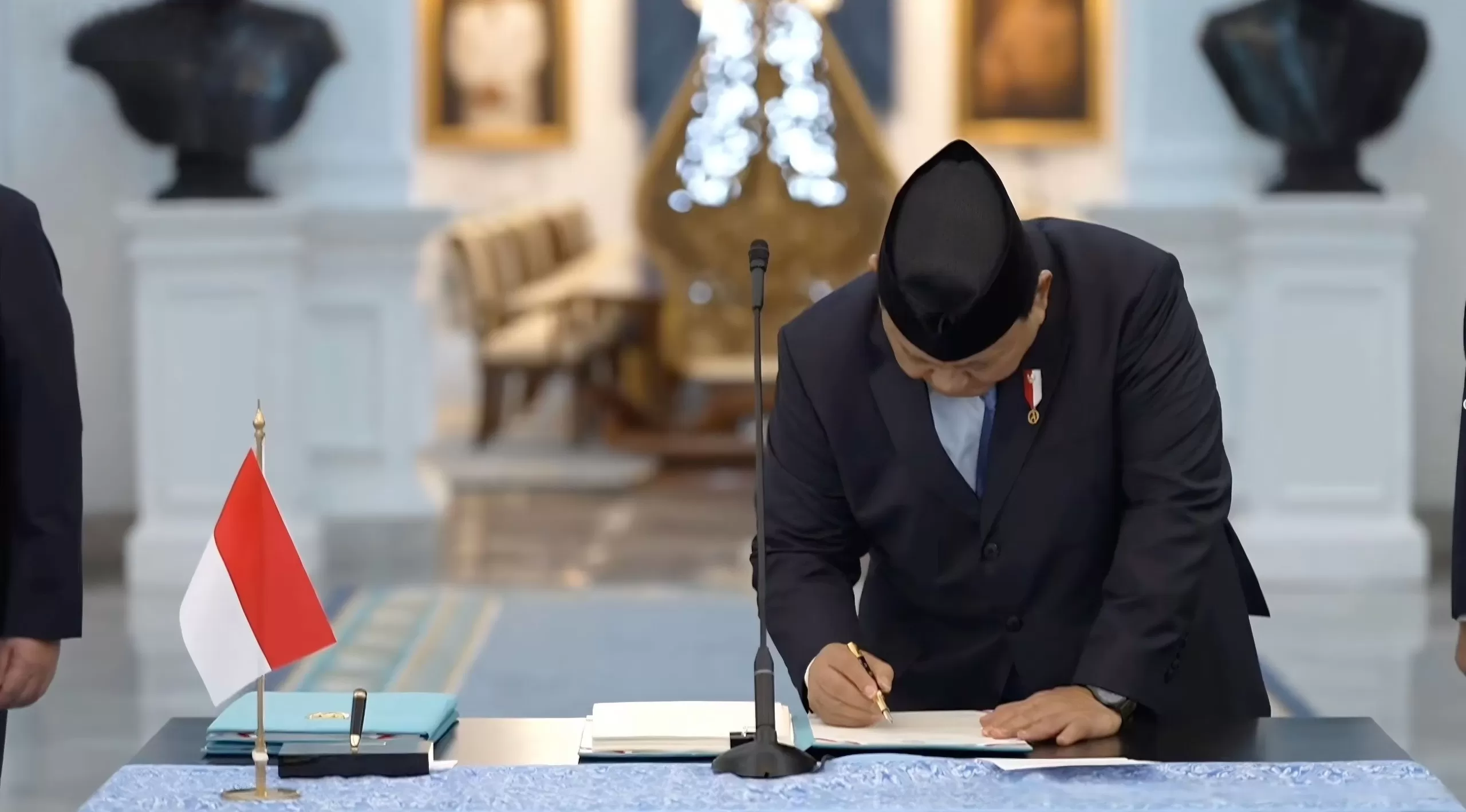

The General Strategy Masterclass: The Hidden Plan Revealed Post-Election

Danantara was never part of President Prabowo campaign promises — deliberately. Even his campaign key economic advisors, Prof. Feri Latuhihin, learned about it only after its announcement. By keeping it secret, opposition from oligarchs and other political forces was preempted. This strategic silence allowed a swift post-election execution. It isn’t just a policy; it’s a grand power maneuver.

The Realization: The Strategy To Navigate Incoming Geopolitical Challenge

Critics mistakenly focus on short-term metrics:

- Stock market reactions

- Debt levels

- BUMN inefficiencies

- Financial returns

They completely overlook the central point:

- It is a fortress for sovereign economic control.

- It regulates foreign investor access, dictating financial flows and terms.

- It will acted as a fuel to accelerate and to realize 77 strategic national projects (PSN).

Danantara isn’t merely financial — it’s GEOPOLITICAL!.

Conclusion: Understanding the Real Game

When we talk about capital at the state level, we must consider another factor that can either enhance or diminish the value of capital itself — and that factor are utilization and control. Most see Danantara as just another bureaucratic entity, completely overlooking the deeper implications of centralized capital allocation.

In reality, whoever controls capital allocation shapes the nation’s future and this is exactly the grand strategy President Prabowo is using to achieve his vision for Indonesia. Critics stay fixated on business aspects, but strategic players recognize it’s true power-centric purpose.