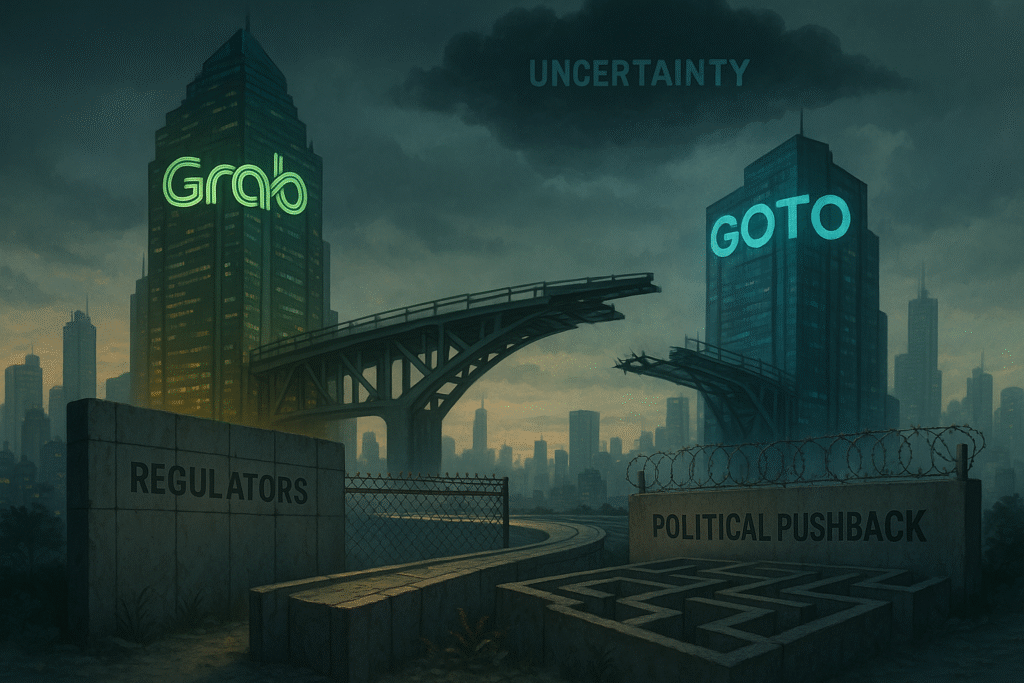

“Grab trades on hype. GOTO trades on doubt. The bridge between them is regulation, politics, and risk. Who survives the crossing?”

The Math for Grab and GOTO

We conducted a full discounted cash flow (DCF) analysis on Grab Holdings using actual 2024 financials to ground the valuation in facts rather than narrative. Our inputs were: revenue of $2.8 billion, adjusted EBITDA of $164 million, and capital expenditures of $113 million. We applied a WACC of 9% and a terminal growth rate of 3%.

The resulting intrinsic fair value is approximately $0.36 per share while the price as of August 2025, ranges from about $4.70 to $5.00 per share. Based on these findings, the current Grab share price is trading at roughly 13 to 15 times its intrinsic value, essentially pricing in about eight years of growth at the expected pace.

Even under optimistic assumptions, a terminal growth rate of 4% and a WACC as low as 7%—Grab’s share price peaks at just $0.70/share. In most grounded scenarios, it ranges from $0.26 to $0.41/share. This stark disconnect clearly indicates that Grab’s current market price is not driven by core business fundamentals. Instead, it’s pricing in strategic expectations.

One of the most plausible expectations baked into Grab’s valuation is the likelihood of a transformative move on acquiring GOTO, the Indonesian tech conglomerate that combines Tokopedia (e-commerce), Gojek (mobility), and GOTO Financial (fintech)—using overvalued stock as currency. Assume Grab were to pursue a stock-based acquisition (high probability), the strategic impacts would be substantial:

- Preserves liquidity – no cash outlay required.

- Transfers overvaluation risk – GOTO shareholders absorb Grab’s inflated equity.

- Aligns incentives – both parties share long-term value creation.

- Frames it as a merger, not a takeover – reducing political and regulatory resistance.

- Dilution becomes a bet on synergy execution – if integration fails, value erodes.

We haven’t yet modeled a DCF for GOTO, not because it lacks importance, but because recent market signals, especially its proximity to Danantara, suggest GOTO is exploring strategic lifelines rather than negotiating from strength. However, this shouldn’t be misread as weakness. With Bank Indonesia cutting rates, GOTO’s weighted average cost of capital (WACC) is structurally declining—creating a more favorable environment for long-duration tech valuations. Lower interest rates reduce the discount applied to future cash flows, meaning GOTO’s intrinsic value is likely trending up, not down. Unfortunately, this repricing hasn’t yet materialized in its stock due to market overhang and sentiment.

In this context, the merger isn’t a deal between equals, it’s a calculated move by one company using inflated stock to acquire another before the market fully adjusts to macro tailwinds.

Who Wins, Who Risks?

Why this deal makes sense for Grab:

- Cheap acquisition via inflated stock – Grab uses overpriced equity to acquire undervalued assets, minimizing real cost.

- Instant market expansion – GOTO gives Grab direct access to Indonesia’s e-commerce, mobility, and fintech footprint.

- Cross-sell synergy – GrabPay + Tokopedia + Gojek create flywheel monetization potential.

- Narrative boost – A successful acquisition reinforces investor belief in Grab’s super-app dominance.

- De-risks Southeast Asia dependency – Reduces exposure to any single market while consolidating regional power.

Why this is risky for Grab:

- Equity dilution – If synergies fail, shareholders absorb permanent value loss.

- Execution risk – Complex integration across tech, culture, and operations.

- Regulatory scrutiny – Potential anti-competition pushback in Indonesia and Singapore.

- GOTO’s liabilities – Grab may inherit unprofitable segments or underperforming legacy assets.

- Market blowback – If markets realize this is a defensive play, valuation may collapse.

Why this deal benefits GOTO:

- Premium exit – GOTO trades its undervalued shares for Grab’s overpriced ones.

- Shared upside – As part of Grab, GOTO can benefit from broader investor appetite and cash flow.

- Operational synergies – Cost savings from platform integration.

- Access to capital – More options under Grab’s umbrella to support Tokopedia or Gojek expansion.

- Strategic realignment – Escape from market stagnation with a new story to tell.

Why this is dangerous for GOTO:

- Losing independence – GOTO may be absorbed and lose its distinct identity.

- Cultural mismatch – Internal clashes may slow execution.

- No control over Grab’s destiny – Future value depends on Grab’s management decisions.

- Short-term premium, long-term risk – Inflated Grab shares may deflate post-deal.

- Vulnerable to execution fallout – If integration goes badly, GOTO’s brand takes a hit too.

Deal Probability Assessment

Based on that analysis and the sentiment from public narrative, we asked our AI model to run the probability of the deal. Interestingly, the AI returned a 30% to 50% probability, reflecting a moderate to low chance of near-term execution.

Reasons Supporting the Deal (Increasing Probability):

- Strategic Fit – The merger offers significant synergies, including expanded market access across Southeast Asia, combined e-commerce, mobility, and fintech platforms, and potential monetization flywheels (e.g., cross-selling GrabPay, Tokopedia, and Gojek).

- Acquisition via Overpriced Stock – Grab can use its relatively inflated equity as currency to acquire undervalued GOTO shares, lowering real cost.

- Potential Government Support – The involvement of Indonesia’s sovereign wealth fund Danantara could help navigate regulatory pushback and increase approval chances.

- Investor Narrative Booster – A successful deal would reinforce Grab’s “super-app” market dominance narrative, appealing to investors.

Factors Lowering the Probability:

- Regulatory Hurdles – Indonesian regulators have expressed strong concerns about potential monopoly risks and have suggested conditions that could make the deal difficult to approve.

- Political and Labor Pushback – Labor unions and other stakeholders worry about negative impacts on competition and drivers, adding political risk.

- Complex Integration Risks – Operational, cultural, and managerial execution risks are significant, carrying the possibility of value destruction.

- Market and Valuation Risks – The market might react negatively if the deal is seen as defensive, and inflated share prices could deflate post-merger, impacting long-term value.

Strategy Over Sentiment

Grab’s valuation is no longer supported by fundamentals alone, it’s supported by belief in bold moves. GOTO, on the other hand, may not hold pricing power in a standalone path but offers valuable assets for any platform seeking regional dominance.

Whether this deal proceeds or not, the analysis surfaces the real question:

Is the current valuation story driven by reality, or by what investors hope these companies will become?

And in capital markets, timing that belief is everything.