Capital Must Be Engineered, Not Just Spent.

Or click start here on the menu to learn principles of capital engineering for nation

The Capital Architect: Why Indonesia Must Redesign Growth

Capital Architect reframes growth by challenging the outdated, debt-fueled and disbursement-driven economic model, replacing it with a sovereign capital paradigm. A blueprint for national capital engineering.

For nearly two decades, Indonesia has hovered around 5% annual GDP growth — a number that policymakers, markets, and institutions have come to accept as “normal.”

But the real truth at this apparent stability lies two dangerous imbalances.

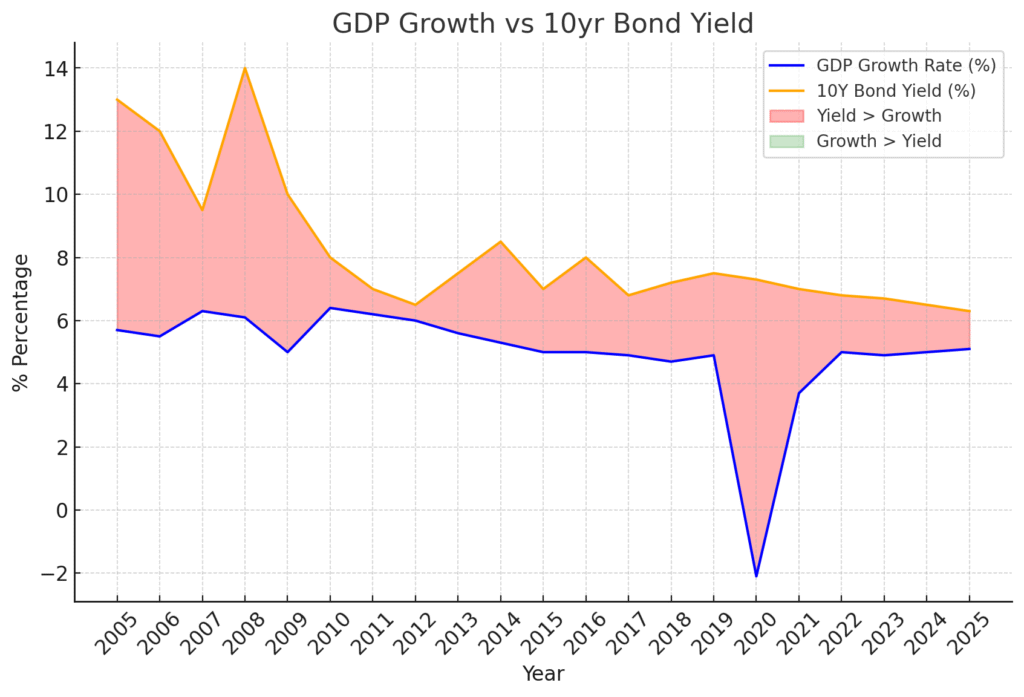

First, In 2025, Indonesia’s 10-year bond yields are projected at 6.8%, while real GDP growth stands at 5.12%. This gap matters. It means the cost of borrowing exceeds the nation’s productive return. Every rupiah borrowed is not compounding growth — it is eroding the foundation. What looks like development is, in fact, silent erosion of economic strength.

The shaded zones highlight the years when Indonesia’s 10-year bond yields outpaced real GDP growth. These are periods when debt financing did not generate returns high enough to cover its own cost. Instead of strengthening the economy, borrowing became a drag. Over the last two decades, this pattern reveals that much of our growth was financed at a net loss.

Second, Deficits are funded with debt — that part is obvious. What’s not obvious, and far more dangerous, is the destination of that capital. Where does it actually go? Does it come back?. The evidence suggests a troubling pattern: funds disbursed without purpose, without systems to track returns, and without mechanisms to measure effectiveness. This is less strategy and more spending like a drunken sailor. It’s not just inefficiency; it’s a betrayal of national capital.

The Capital Trinity

Capital Governance

From passive budget management to active control of strategic capital.

Capital Intelligence

Using logic and insight to allocate—not just disburse—resources.

Capital Allocation

Multiplying value across generations through engineered investments.

Latest Frameworks

- Indonesia Investment Authority (INA) 2.0: From Project Partner to Sovereign Capital Architect

- Structuring Danantara and INA in One Roof: The Missing Blueprint of Indonesia SWF

- Benchmarking Danantara Indonesia to Abu Dhabi SWF Playbook: Go Big or Go Home!

- Inside the Capital of Capital: Abu Dhabi SWF’s Playbook and the Future of Danantara Indonesia

About the Architect

This framework wasn’t designed by an Economist. It was designed by an Indonesian Engineer.

An Engineer who saw what others missed: that capital is not just money—it is architecture, discipline, and power.

This is my signature. My blueprint. My legacy.